When selecting the right car insurance plan, it's important to consider various vehicle coverage options under auto insurance policies to find one that aligns with your needs and budget. Utilize vehicle insurance comparison tools to assess motor insurance quotes from different providers, ensuring you get affordable auto insurance without compromising essential coverage. Factors like your vehicle type, driving history, and location will influence car insurance rates, but by exploring discounts such as those for safe drivers or multi-car policies, you can optimize your plan. Regularly updating your coverage ensures it adapts to your changing circumstances, maintaining both cost-effectiveness and comprehensive protection against road incidents. By understanding the options available in motor insurance quotes and using comparison tools, you can navigate the complexities of car insurance rates confidently, securing a plan that offers robust financial security without overspending.

When it comes to safeguarding your vehicle, a clear grasp of car insurance plans and their coverage options is key. This article demystifies the various vehicle coverage options available within auto insurance policies, ensuring you make informed decisions. From comprehensive protection against accidents and natural disasters to strategically leveraging car insurance rates and discounts for safe driving or bundling with other policies, we guide you through the process of selecting a plan that fits your needs without compromising on essential coverage. By utilizing vehicle insurance comparison tools and regularly reviewing your motor insurance quotes, you can stay ahead, tailoring your policy to provide optimal protection for your assets on the road.

- Maximizing Your Car Insurance Plan: A Comprehensive Guide to Vehicle Coverage Options

- Navigating Auto Insurance Policies: Understanding the Impact of Car Insurance Rates and Discounts

- Leveraging Vehicle Insurance Comparison Tools for Affordable Auto Insurance Solutions

- Tailoring Your Motor Insurance Quotes: Regular Reviews for Optimal Protection

Maximizing Your Car Insurance Plan: A Comprehensive Guide to Vehicle Coverage Options

When delving into the realm of auto insurance policies, understanding your car insurance plans and exploring vehicle coverage options is paramount. A robust car insurance plan should be tailored to your specific needs, offering a shield against unforeseen events such as accidents, theft, or natural disasters. To maximize your benefits, it’s advisable to examine the various vehicle coverage options available. These may include collision, comprehensive, liability, personal injury protection, and uninsured/underinsured motorist coverage. Each serves a distinct purpose and can be customized within your car insurance plans.

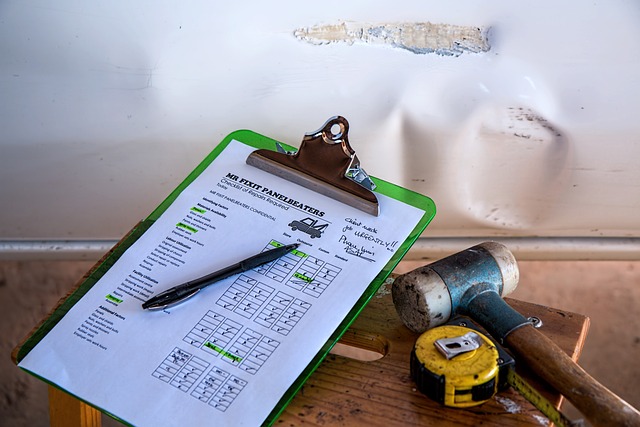

To navigate the market effectively and find affordable auto insurance without compromising on essential coverage, make use of vehicle insurance comparison tools. These resources allow you to compare car insurance rates across different providers, taking into account your unique situation. Additionally, don’t overlook the potential savings from vehicle insurance discounts, which can be applied for a variety of reasons such as safe driving records or by bundling your policies with the same insurer. By carefully reviewing and updating your motor insurance quotes regularly, you ensure that your car insurance plans remain aligned with your evolving needs, providing optimal protection and financial security on the road.

Navigating Auto Insurance Policies: Understanding the Impact of Car Insurance Rates and Discounts

When delving into auto insurance policies, it’s crucial to comprehend the intricacies of car insurance rates and the various discounts available to tailor your car insurance plans effectively. Car insurance rates are influenced by a myriad of factors, including the type of vehicle you drive, your driving history, location, and the level of coverage you choose under your vehicle coverage options. To optimize your motor insurance quotes, it’s wise to explore all potential discounts. These may include rewards for safe driving habits, multi-car policies when you bundle several vehicles under one plan, or even loyalty programs from longstanding relationships with an insurer. By leveraging these discounts, you can secure comprehensive car insurance plans that offer robust protection without straining your budget.

In today’s market, utilizing vehicle insurance comparison tools is a prudent step in finding affordable auto insurance that suits your financial situation while maintaining essential coverage. These tools allow for the analysis of various motor insurance quotes from different providers, enabling you to make an informed decision based on the best rates available for the specific coverage you require. Regularly reviewing and updating your car insurance plans ensures they remain aligned with your evolving needs, providing peace of mind that your assets are adequately protected. By staying abreast of changes in your personal circumstances and the market, you can ensure your vehicle insurance remains both cost-effective and comprehensive, safeguarding against unforeseen events on the road.

Leveraging Vehicle Insurance Comparison Tools for Affordable Auto Insurance Solutions

Navigating the car insurance market can be overwhelming with a plethora of auto insurance policies and car insurance plans available. To streamline the selection process, vehicle insurance comparison tools emerge as invaluable assets for consumers seeking affordable auto insurance solutions. These tools enable users to input their specific vehicle coverage options and requirements, then compare various motor insurance quotes across different insurers. By entering details such as make, model, driving history, and desired coverage levels, individuals can quickly identify plans that best fit their needs without breaking the bank. The comparison feature is particularly beneficial as it allows for a side-by-side evaluation of car insurance rates, ensuring consumers are aware of the most cost-effective options available. Moreover, these tools often account for vehicle insurance discounts, such as those for safe driving or when bundling policies with other types of insurance, thereby maximizing savings while maintaining comprehensive coverage. Regular use of these comparison tools can lead to significant financial benefits and provide peace of mind that one’s auto insurance policies are both affordable and robust enough to handle various contingencies.

Tailoring Your Motor Insurance Quotes: Regular Reviews for Optimal Protection

Navigating the array of car insurance plans available can be overwhelming, but tailoring your motor insurance quotes to fit your specific needs is crucial for optimal protection. To start, consider your vehicle coverage options within your auto insurance policies. These options encompass a spectrum of protections from liability coverage to comprehensive coverage that addresses various incidents such as accidents, theft, or natural disasters. By regularly reviewing your car insurance rates and the associated benefits, you can ensure that your motor insurance quotes align with your evolving requirements. This practice allows for adjustments to your plan as needed, whether it’s adding new coverage or switching providers for more competitive rates.

Utilizing vehicle insurance comparison tools is an invaluable resource when seeking affordable auto insurance without compromising on essential coverage. These tools enable you to compare car insurance plans across different insurers, highlighting the best combination of cost and protection. By taking advantage of these comparisons, you can identify which car insurance rates offer the most comprehensive coverage for your budget. Additionally, don’t overlook the vehicle insurance discounts available, such as those for safe driving records or bundling multiple policies. These discounts can significantly reduce your premiums while still providing robust coverage, ensuring that you are not overpaying for your auto insurance policies. Regularly updating your motor insurance quotes to reflect these changes will provide you with peace of mind, knowing that you have the most suitable car insurance plan tailored to your needs.

When it comes to safeguarding your vehicle and your finances, a thorough understanding of car insurance plans and their coverage options is paramount. This guide has demystified the complexities of auto insurance policies, highlighting the value of comprehensive car insurance and the benefits of exploring vehicle coverage options tailored to your specific needs. By considering car insurance rates and taking advantage of available discounts for safe driving or bundling, you can secure affordable auto insurance that doesn’t compromise on essential protection. Utilizing vehicle insurance comparison tools empowers you to make informed decisions, ensuring your motor insurance quotes align with your current circumstances. For optimal security and financial prudence, it is wise to regularly review and update your car insurance plans. Doing so not only maximizes your coverage but also ensures that your policies continue to meet your evolving requirements effectively.